Abstract

Following the enthusiastic response to its first two sessions, EXIO Group recently successfully hosted its third closed-door Real World Asset (RWA) project selection event. Web3 credit analysis firm Kriteria was once again invited as an independent evaluator. The session focused on income-generating RWA projects deeply embedded in the real economy and capable of producing predictable cash flows. It assessed the market acceptance and allocation value of cash flow-based assets with varying risk-return characteristics and structural designs after tokenization. Underlying assets spanned multiple sectors including commercial real estate, hydropower stations, agricultural machinery leasing, game operations, artworks, and computing power revenue rights, demonstrating the feasibility and scaling potential of tokenizing real-world assets across diverse scenarios.

As a “converter” bridging real-world cash flows with on-chain capital markets, RWA provides an efficient digital migration pathway for cash flow assets: on one hand, it opens transparent, traceable financing channels for traditional industries; on the other, it delivers sustainable real-world returns to Web3 investors. Amid Hong Kong’s proactive policy environment for compliant RWA development, meeting institutional investors’ governance, risk management, and disclosure requirements through compliant, robust, and transparent frameworks has become pivotal to RWA’s evolution into an efficient, inclusive new financial infrastructure.

This report systematically introduces six representative income-generating RWA projects and integrates on-site anonymous voting results for quantitative analysis. Voting data indicates investors exhibit higher interest and confidence in stable cash flow assets (e.g., hydropower station revenue rights), while high-growth projects (e.g., gaming revenue and art STOs) attract more “whale” investors. RWAs are emerging as a pivotal channel for channeling digital capital from virtual to real-world applications. While their long-term evolution remains contingent on multiple factors—including regulatory compliance, asset mapping capabilities, cash flow predictability, and DeFi scalability—their core value in reshaping next-generation financial infrastructure is already evident.

Project Analysis

This selection meeting focuses on six projects that cover a diverse range of real-world asset (RWA) types. Each project demonstrates how RWAs can tokenize real-world cash flows, providing verifiable and tradable digital certificates. Below are detailed descriptions of the projects:

Hydropower Station Revenue Rights: Stable Cash Flow Infrastructure

This project tokenizes the future cash flows from two hydropower stations that have been in stable operation for over a decade. The project has a long-term electricity sales and settlement arrangement with the national power grid, ensuring stable returns and predictable cash flows; the operating costs are low, with a profit margin exceeding 70%, demonstrating strong coverage capabilities and resilience to risks. The cross-border issuance adopts a typical QFLP+LPF structure. In terms of revenue targets, the unleveraged expected annualized return is about 7.6%; with commercial bank loans, the target annualized return may rise to approximately 14.8%.

Key Advantages: Strong revenue certainty, traceable operational records, and data transparency offer fixed-income-like stable returns while enhancing liquidity for physical infrastructure assets. The long-term electricity supply contract with the national grid ensures price and volume stability.

Risk Considerations: Revenue sensitivity to fluctuations in the energy market and policy changes requires continuous monitoring of the electricity sales contract terms and performance stability. Additionally, seasonal fluctuations in hydrological conditions and climate change may affect the hydropower station’s electricity generation.

Commercial Real Estate Revenue Rights: Digitalization of Core District Rents

Utilizing mature commercial real estate located in core business districts of China’s top-tier cities as underlying assets, this project tokenizes stable rental and property income. Leveraging scarce location resources, over 18 years of stable operational records, and a clear and transparent ownership and rent structure, the cash flows of this asset exhibit high predictability. The project plans to adopt a QFLP+LPF structure for cross-border issuance. The annualized return target under a non-leveraged model is approximately 7.3%, which can be enhanced to around 11.8% under a leveraged scheme involving commercial bank loans.

Key Advantages: Enhances liquidity of large real estate and lowers investment thresholds, suitable for institutional asset allocation. The property is located in a core district, with a long-term lease record and high occupancy rates, and employs differentiated leasing strategies to optimize tenant structure and enhance rental resilience.

Risk Considerations: Impacted by real estate market cycles, it is essential to assess rental recovery rates and fluctuations in location value. The supply-demand dynamics in commercial real estate remain uncertain, necessitating ongoing monitoring of market vacancies and new supply pressures.

Agricultural Machinery Leasing Receivables: Intelligent Financing for Agricultural Assets

This project tokenizes future revenue rights generated from agricultural machinery leasing. The issuer is a leading domestic digital service provider for rural assets, with a solid foundation in industry partnerships. The underlying assets enjoy clear national policy subsidies, significantly enhancing the security of base rental income. As one of the first RWA attempts involving agricultural assets in China, this project provides a new channel for global capital to participate in smart agriculture in China. The project plans to adopt a QFLP+LPF structure for cross-border issuance. The target annualized return for the base model without credit enhancement is about 8% to 10% (depending on the accounting period and discount rate); with structured schemes involving bank credit enhancement or policy subsidies, the target return range is expected to be further optimized.

Key Advantages: Policy subsidies enhance security, providing fixed-income investment opportunities in the agricultural sector. The issuer is a leader in the digitization of rural asset data, with traceable data records and high transparency. The agricultural and machinery leasing sector exhibits counter-cyclical characteristics and is continuously supported by policy.

Risk Considerations: Uncertainties in the agricultural market and changes in subsidy policies may affect recovery rates and require ongoing monitoring. While the income structure is stable, there is limited upside; adjustments to subsidy policies may further compress upside potential.

Computing Power Leasing Revenue Rights: High Flexibility in AI Earnings

This project tokenizes the revenue rights from leasing computing power at AI data centers, with underlying assets comprising a high-performance computing cluster being constructed in phases (totaling 100,000 computing cards planned). Cash flows primarily come from signing power consumption agreements with leading technology companies and daily leasing income, featuring revenue flexibility through “overselling computing power” during tight supply-demand conditions. The project also introduces on-chain data validation to disclose leasing and payment data in real-time, enhancing revenue transparency and verifiability. It plans to use a QFII/QFLP cross-border structure, with an expected annualized return of about 6%.

Key Advantages: Entry into the high-growth AI computing power sector, providing compliant channels and transparent data verification. The issuer has signed long-term usage agreements with technology company clients, offering high visibility of cash flows.

Risk Considerations: Fluctuations in supply and demand in the tech industry and rapid depreciation of hardware pose risks, necessitating careful evaluation of agreement stability and equipment residual value.

Game Development and Operation Platform Revenue: High-Frequency Cash Flow Distribution

This project tokenizes operational cash flows from self-developed and co-operated games in the European market, with underlying assets comprising multi-channel income generated from game publishing and operations, as well as net profit sharing attributable to the parent company. Distributions are made based on 50% of the net profit attributable to the parent company, with daily airdrops of BTC forming a high-frequency, verifiable cash flow distribution mechanism. The issuance is intended to be implemented at the offshore subsidiary level, with tokens in the form of ecosystem coins, having the same duration as the project company, and establishing exit windows in the third and fifth years.

Key Advantages: Clear revenue structure that converts high-growth internet businesses into tradable digital assets. Commitment to daily profit distributions enhances transparency. With the continuous growth of online game users, if new titles successfully increase market share, there is potential for revenue upside.

Risk Considerations: Intense competition in the gaming industry and fluctuations in user engagement require monitoring of revenue diversity and sustainability. A single product’s failure could significantly impact overall revenue.

Blue-Chip Artwork STO: Fragmented Financing in the Art Market

Through compliant Security Token Offering (STO), this project achieves fractional ownership and collateral financing of blue-chip artworks. The underlying assets are verified by experts and fully insured, supporting art collateral loans with a maximum LTV of 50%. Cash flows come from various sources, including collateral loan commissions and management fees, primary issuance and secondary trading service fees, institutional collection tokenization subscriptions, partner alliance commissions, and data analysis and market report subscriptions. The project strictly adheres to multiple regulatory frameworks, including Hong Kong SFC, US SEC, and EU MiCA, with an expected annualized return of approximately 10% to 15%.

Key Advantages: Addresses the high entry barriers and low liquidity of the traditional art market, providing easier access and diversified cash flow investment avenues.

Risk Considerations: The subjective nature of artwork value and market volatility necessitate ensuring robust insurance and verification mechanisms. Additionally, the custody, insurance, and operation of underlying physical assets may introduce operational risks.

Voting Results

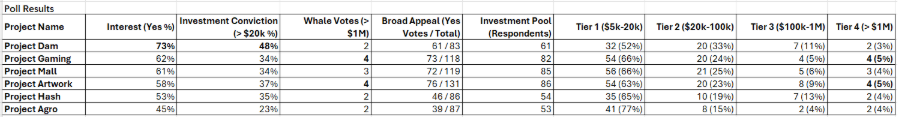

Description: Investment Conviction (>$20k) = the total percentage of Tier 2 + Tier 3 + Tier 4.

Analytical Insights:

Preference for Stable Assets: Hydropower station revenue rights ranked first in interest (73%) and investment conviction (48%), reflecting traditional institutional investors’ confidence in high-certainty, strong coverage, and clearly structured infrastructure assets. Its broad appeal (61/83) and low whale voting (2) indicate that this project is more suitable for mid-tier investors (Tier 1 at 52%), emphasizing the attractiveness of RWA in providing stable returns akin to fixed income.

Attractiveness of High-Growth Projects: Game revenue and blue-chip art STO attracted the most whale votes (4 each), with larger investment pools (82 and 86), indicating that high-risk tolerance capital is drawn to high-growth, imaginative digital assets. Although interest levels were lower (62% and 58%), their investment conviction (34% and 37%) and Tier 3/4 ratios suggest these projects are suitable for professional investors seeking high returns.

Overall Trends: Commercial real estate revenue rights led in investment pools (85), indicating widespread institutional interest; agricultural machinery leasing had the lowest interest (45%), possibly due to policy dependence and higher uncertainty associated with agricultural assets. The Tier 3 ratio for computing power leasing (13%) is relatively high, reflecting the growth potential of the AI sector. Overall, voting results validate the diverse allocation value of RWA: stable assets attract broad participation, while high-flexibility projects are more appealing to high-risk tolerance capital.

Risk-Return Trade-Off: The revenue target under the unleveraged model (approximately 6%–10%) positively correlates with voting conviction; low-risk projects like hydropower stations receive higher support. Leveraged schemes (increasing to 11.8%–14.8%) may amplify attractiveness, but risk control needs to be strengthened to meet institutional requirements.

Conclusion and Recommendations

RWA is becoming a key channel for guiding digital capital from “virtual to real.” This selection meeting highlights the potential of RWA to connect the real economy with on-chain capital, sketching a future blueprint where stability and innovation collide: it not only replicates traditional finance but also pioneers inclusive pathways within a compliant framework. By bringing verifiable cash flows from hydropower, real estate, agriculture, and computing power on-chain, it injects new liquidity into traditional industries and introduces sustainable returns derived from real-world value creation into the Web3 ecosystem. Although the long-term evolution of the RWA narrative still faces challenges in compliance, asset mapping capabilities, cash flow predictability, and DeFi scalability, its core value in reshaping financial infrastructure as a robust bridge between Web3 and the real economy is already evident.

RWA is becoming the engine of global asset liquidity, offering investors richer choices and flexible allocations. It is recommended that the industry strengthen compliance innovations and monitor policy and technological advancements to accelerate the scalable application of RWA.

About Kriteria

Kriteria is a professional Web3 credit analysis firm. In the rapidly evolving virtual asset landscape, a reliable and transparent risk assessment framework is the cornerstone of industry development. To this end, Kriteria collaborates with leading financial institutions and industry partners, combining collective expertise with data-driven rigorous research to build unified risk assessment standards and a “consensus rating” system. Our mission is to provide the market with clear, actionable analytical frameworks, fostering trust infrastructure for virtual assets and supporting the industry’s standardization and sustainable growth.

About EXIO Group

EXIO Group is a global leader in bridging traditional finance (Web2) and Web3 ecosystems, delivering innovative, compliant, and secure financial solutions. Headquartered in Hong Kong, the group operates through multiple subsidiaries, including EXIO Limited (a compliant virtual asset trading platform regulated by the Hong Kong Securities and Futures Commission, VATP) and EXIO FZCO (currently applying for a VASP license from Dubai’s VARA). EXIO Group’s mission is to empower global users through cutting-edge Web3 financial services, combining regulatory compliance, advanced technology, and deep banking partnerships to serve institutional, high-net-worth, and retail clients.

Disclaimer: The content provided here is for reference and educational purposes only. Virtual asset prices are subject to high market risk and volatility. The value of your investments may decrease or increase, and you may not recover your invested amount. You bear full responsibility for your investment decisions, and we are not liable for any losses you may incur. You should only invest in products you understand and whose risks you are aware of. Carefully consider your investment experience, financial situation, investment objectives, and risk tolerance, and consult an independent financial advisor before making any investments. Past performance is not a reliable indicator of future results. The content on our platform does not constitute advice or recommendations. This material should not be considered financial or investment advice.